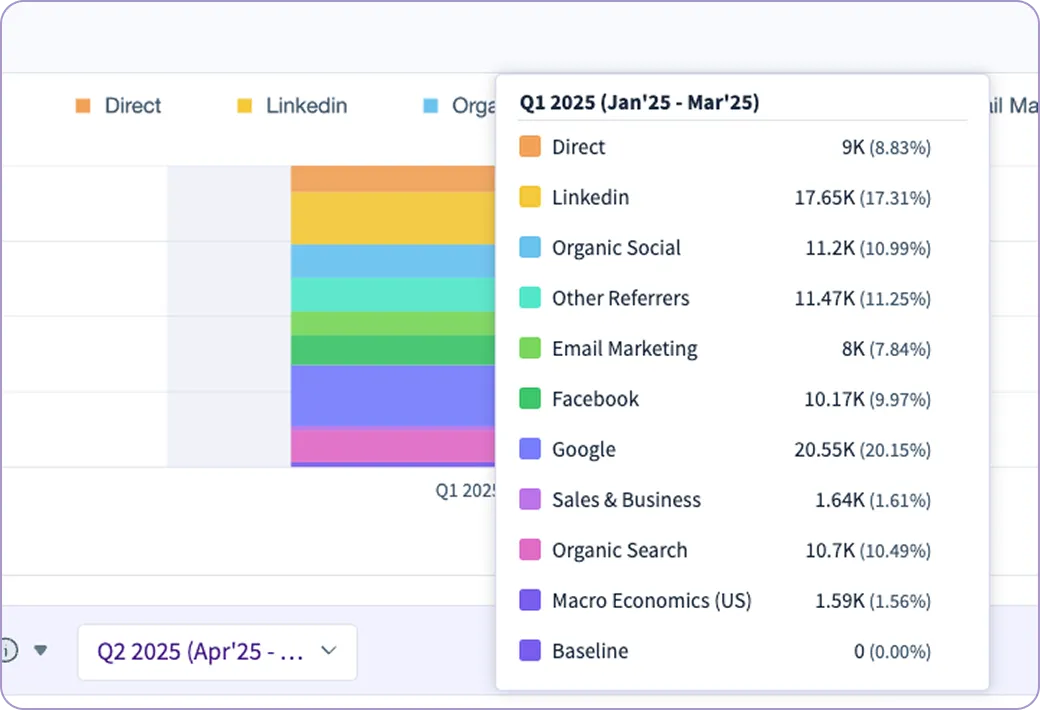

Agent.ai, an AI-powered platform that helps businesses automate customer interactions, entered 2025 with ambitious goals focused on deep user engagement. In Q1 2025, Agent.ai grew its base to over 1 million new sign-ups, primarily via Google Ads, but faced a lingering question:

“Are our marketing dollars—especially LinkedIn’s—actually moving users forward into high-value, long-term adoption? Should we be spending even more on LinkedIn?”

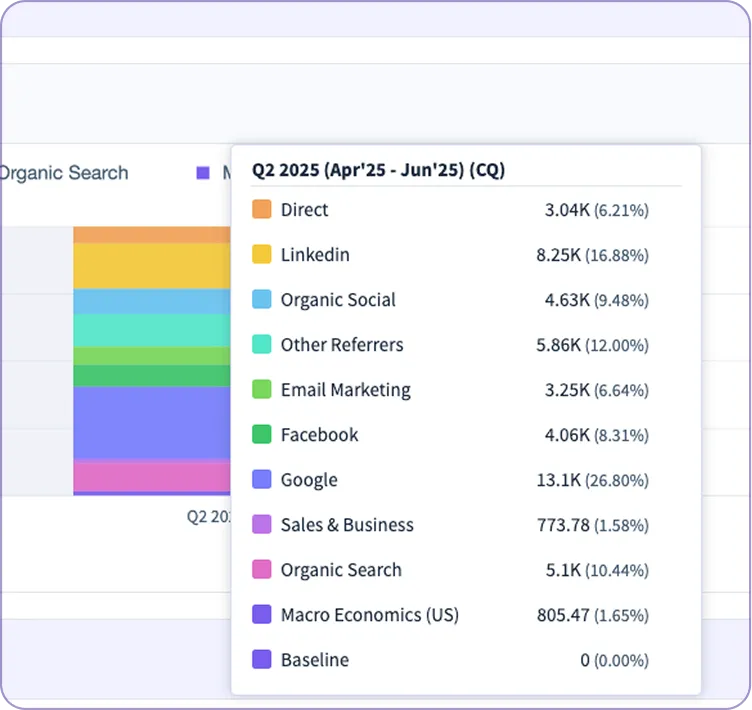

Fast-forward to Q2 2025: within the first 24 days of the quarter, Agent.ai observed a significant acceleration—not in raw sign-ups, but in the activation of long-term, multi-agent users from the existing pool of members.

.webp)

.svg)