Most B2B forecasts don’t fall apart at the end of the quarter. The problems actually begin right from the start.

From the first day, assumptions are already getting outdated. By the second week, the market has changed. By the middle of the quarter, teams are already explaining the gaps. When leaders finally respond, budgets are fixed, sales resources are committed, and the numbers can’t really change. This isn’t because teams aren’t working hard or don’t have enough data. The real issue is that traditional forecasting methods stay the same, while the business world keeps changing.

Traditional forecasts are built to answer one question: What do we think will happen this quarter? They use past averages, fixed conversion rates, and simple pipeline math. Once set, these forecasts become performance benchmarks instead of assumptions that get tested and updated.

The problem is that B2B growth rarely follows the same path every quarter. Buyer behavior shifts. Channels saturate. Deal cycles stretch. Competition intensifies. Yet forecasts are still anchored to assumptions made weeks or months earlier. This creates a false sense of stability: the forecast looks solid on paper, while real conditions are changing underneath.

Most go-to-market teams can see what’s happening. Dashboards update every day. Pipeline reviews are held every week. But just seeing data isn’t the same as being able to predict what’s coming. Early warning signs are often small and easy to overlook. They show up as leading indicators like:

- Pipeline is being created, but with lower efficiency

- Deals are moving forward, but more slowly

- Spend continues while marginal returns flatten

Static forecasting models can’t react to these signals. They just track progress against the plan, without checking if the plan still fits. By the time it’s obvious the forecast is off, it’s usually too late to change how the quarter ends.

Forecasting Breaks Because It Ignores the Revenue System

Revenue results don’t come from single activities. They come from a system where marketing spend, demand quality, pipeline timing, and buyer behavior all work together over time.

Traditional forecasting methods have to simplify this system. They look at channels separately, assume conversion paths don’t change, and depend a lot on lagging indicators like late-stage pipeline or closed deals. In today’s B2B world, those indicators show up too late to help. By the time they change, the real causes have already shifted weeks before.

What teams need instead is a real-time understanding of how the revenue system is behaving now, and how today’s signals are likely to shape future results.

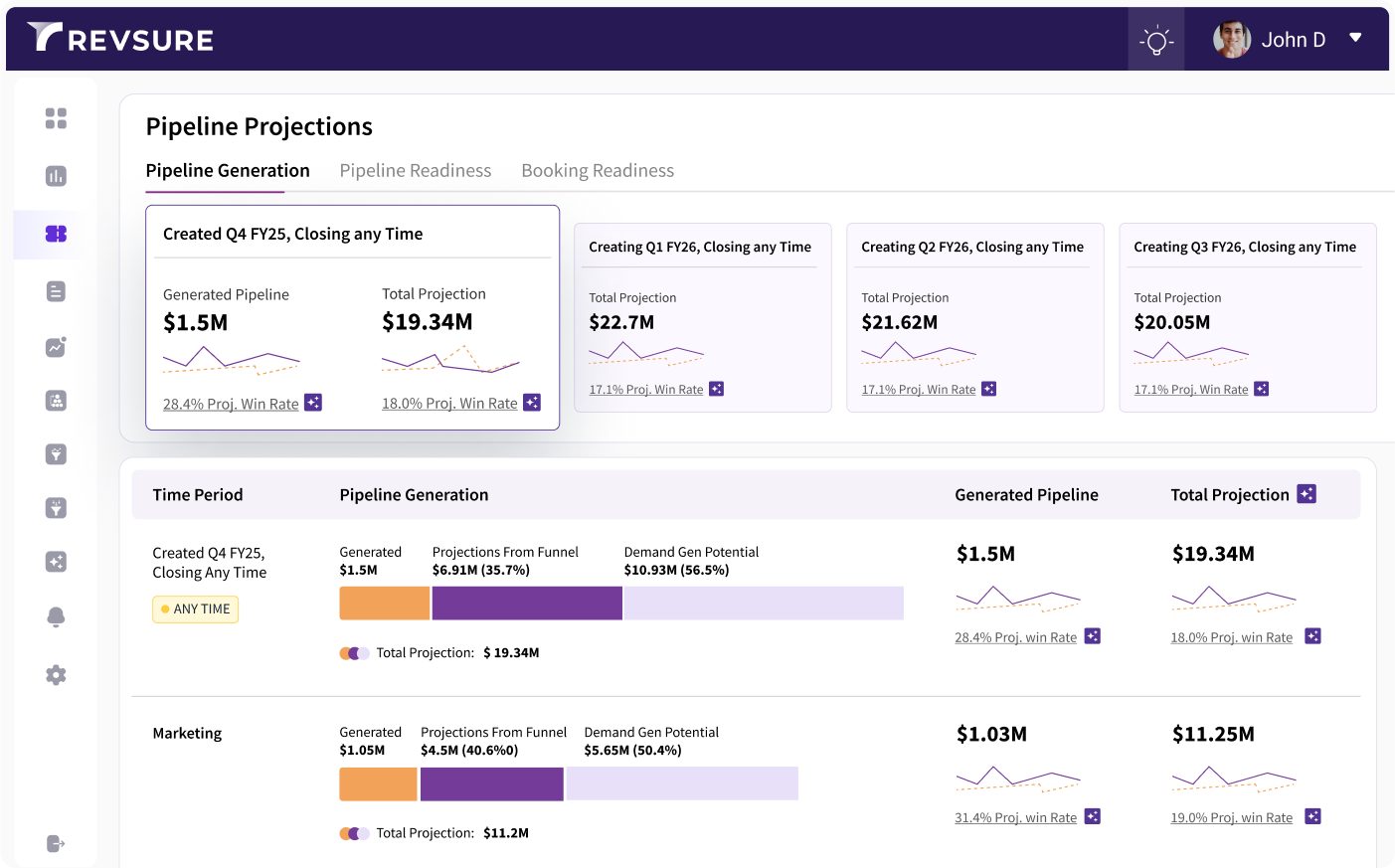

This is why full-funnel intelligence matters. Platforms like RevSure’s Full Funnel AI Platform treat marketing, sales, and revenue as one connected system instead of separate parts. RevSure lets teams model the full funnel, from spend and demand creation to pipeline progress and bookings, so they can:

- Detect early shifts in efficiency, such as declining pipeline quality, slowing velocity, or channel saturation

- Connect leading indicators to revenue impact, showing how today’s performance shapes future outcomes

- Replace fixed assumptions with dynamic signals that allow teams to stress-test plans as conditions change

- Align marketing, sales, and finance around a shared, system-level view of revenue performance

For example, teams can see how a slowdown in the middle of the funnel today could affect bookings six to eight weeks from now, while there’s still time to adjust spending, pacing, or expectations.f asking whether teams are on track against a static forecast, full-funnel intelligence asks a more useful question: Is the revenue system behaving in a way that will still produce the outcome we expect?

From Static Forecasts to Predictive Intelligence

Predictive forecasting replaces fixed assumptions with continuous learning.

Rather than locking expectations at the start of the quarter, predictive models constantly compare current performance to expected trends. They use leading indicators, changes in channel efficiency, pipeline creation, deal speed, and conversion behavior, to predict where results are heading.

This fundamentally changes the role of forecasting. Instead of asking, “Are we on track?” teams can ask, “Given what’s happening now, where are we likely to land, and what can still change that outcome?”

Static forecasts explain performance after the fact. Predictive models help change it before it’s locked in.

This shift also changes when teams can take action. In B2B, most changes happen too late, under end-of-quarter pressure. This leads to rushed pipeline generation, aggressive discounts, or unrealistic sales targets. Predictive forecasting brings risks to light earlier, when teams can still do something about them. Budgets can be moved, pacing adjusted, and expectations reset based on data, not just hope.

Why Responsiveness Is the Real Advantage

Forecasting has usually been measured by how accurate it is. But in fast-changing markets, accuracy alone doesn’t help much if you can’t adapt. A forecast that updates slowly, even if it was once right, leaves teams at risk. A forecast that keeps adapting helps leaders make better decisions, even as the numbers change.

When forecasting becomes predictive, there are fewer surprises. Risks show up sooner. Decisions are more thoughtful. Marketing, sales, and finance work together better. Forecasts move from being static commitments to dynamic guides, tools that help organizations handle uncertainty instead of just reacting to it.

Traditional forecasts were made for a slower world, where assumptions lasted longer, and change happened slowly. That world is gone. The future of forecasting isn’t about better spreadsheets or more updates. It’s about systems that spot change early, understand what it means, and guide action all the time.

The real failure in forecasting isn’t missing the target at the end of the quarter. It’s realizing too late that missing it was bound to happen, and nothing was done when there was still time to make a difference.

Related Blogs